irs income tax rates 2022

Income tax rates from a low of 58 to. The tax rate increases as the level of taxable income increases.

2022 2023 Tax Brackets Rates For Each Income Level

Nov 10 2021 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

. 2022 Tax Brackets. The IRS tax tables MUST. There are seven federal tax brackets for the 2021 tax year.

Whether you are single a head of household. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. The IRS recently released the new inflation adjusted 2022 tax brackets and rates.

2022 New Jersey Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Maine has a variety of taxes. Tax returns in the more narrow sense are reports of tax liabilities and payments often including financial information used to compute the tax.

Your bracket depends on your taxable income and filing status. Inheritance from 31956 to 79881. A very common federal tax form is IRS Form.

Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. These are the rates for. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

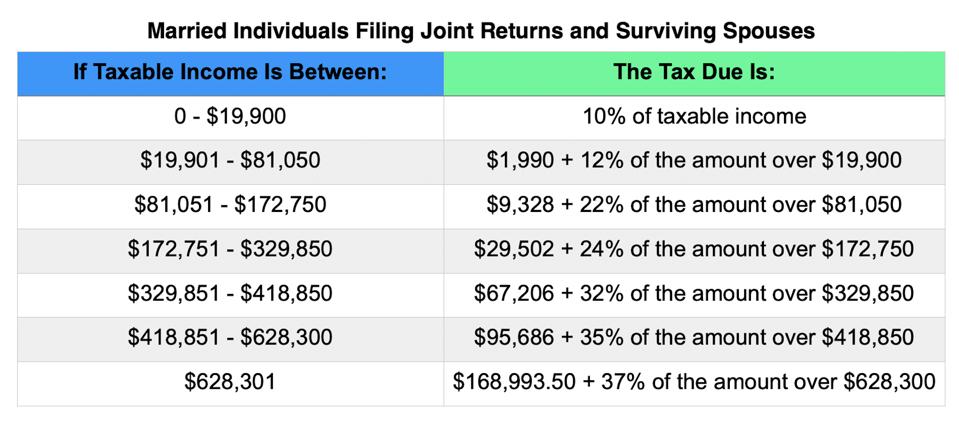

Here are the different taxes and the related rates. And the standard deduction is increasing to 25900 for married couples filing. 35 for incomes over 215950 431900 for.

Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single. The Kiddie Tax thresholds are increased to 1150 and 2300. The refundable portion of the Child Tax Credit has increased to 1500.

The IRS has announced higher federal income tax brackets for 2022 amid rising inflation. The United States Internal Revenue Service uses a tax bracket system. The 2022 tax rate ranges from 10.

Compare your take home after tax and estimate. Tax brackets for income earned in 2022. 43500 X 22 9570 - 4383 5187.

Each month the IRS provides various prescribed rates for federal income tax purposes. Importantly your highest tax bracket doesnt reflect how much you pay in federal. There are seven federal income tax rates in 2022.

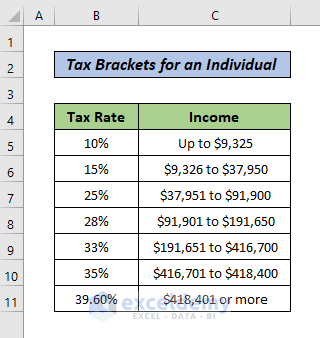

IRS provides various prescribed rates for income tax purposes. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Explore updated credits deductions and exemptions including the standard deduction. 10 12 22 24 32 35 and 37. Since a composite return is a combination of various.

How Do Federal Income Tax Rates Work Tax Policy Center

How To Calculate Federal Tax Rate In Excel With Easy Steps

Us Tax Changes For 2015 Us Tax Financial Services

Irs Announces New Tax Brackets And Deductions For Tax Year 2022

What Is The Difference Between The Statutory And Effective Tax Rate

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

How The Tcja Tax Law Affects Your Personal Finances

State Income Tax Rates And Brackets 2022 Tax Foundation

How To Calculate Federal Income Tax

Inkwiry Federal Income Tax Brackets

What Is The Difference Between The Statutory And Effective Tax Rate

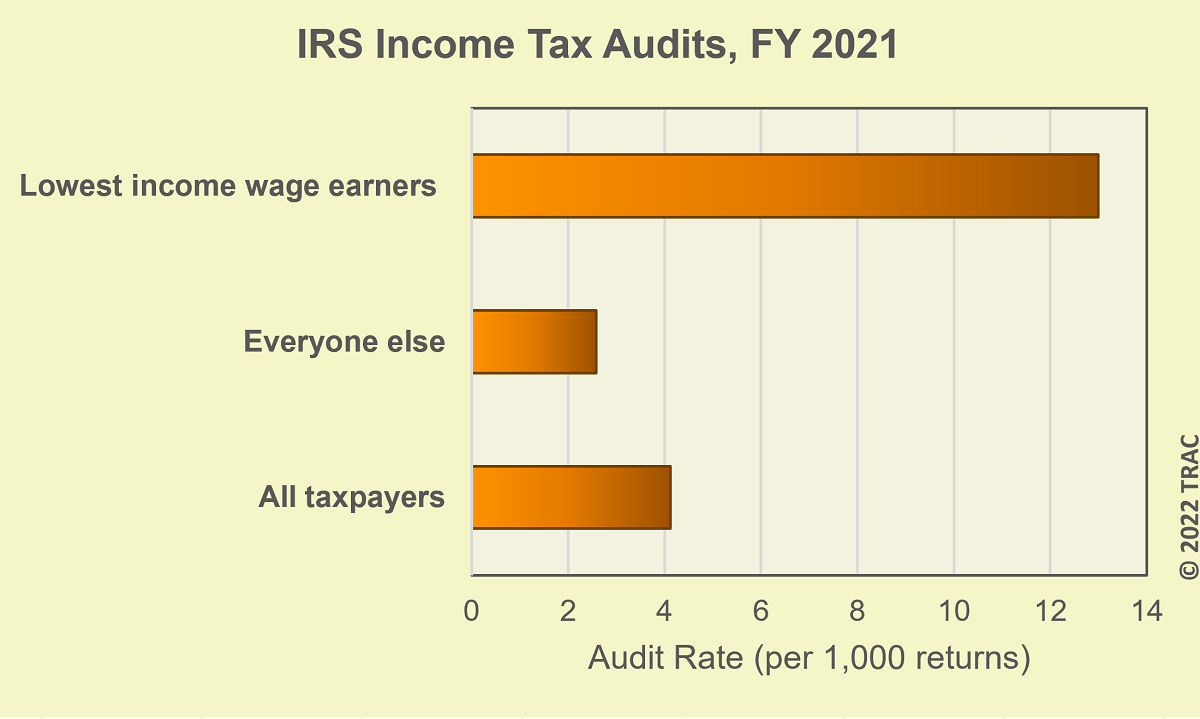

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Summary Of The Latest Federal Income Tax Data Tax Foundation

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger